What Is Proof of Income?

Proof of income is documentation verifying the amount of income you receive regularly or have received recently. It’s used by lenders and landlords to make sure that people entering credit contracts and lending agreements can actually make the payments they are agreeing to.

Proof of income is documentation verifying the amount of income you receive regularly or have received recently. It’s used by lenders and landlords to make sure that people entering credit contracts and lending agreements can actually make the payments they are agreeing to.

Being able to provide proof of income is a necessary step for getting personal and auto loans, taxes, renting, or even refinancing your mortgage. Understanding the ins and outs of proving income can make a huge difference to your personal finances!

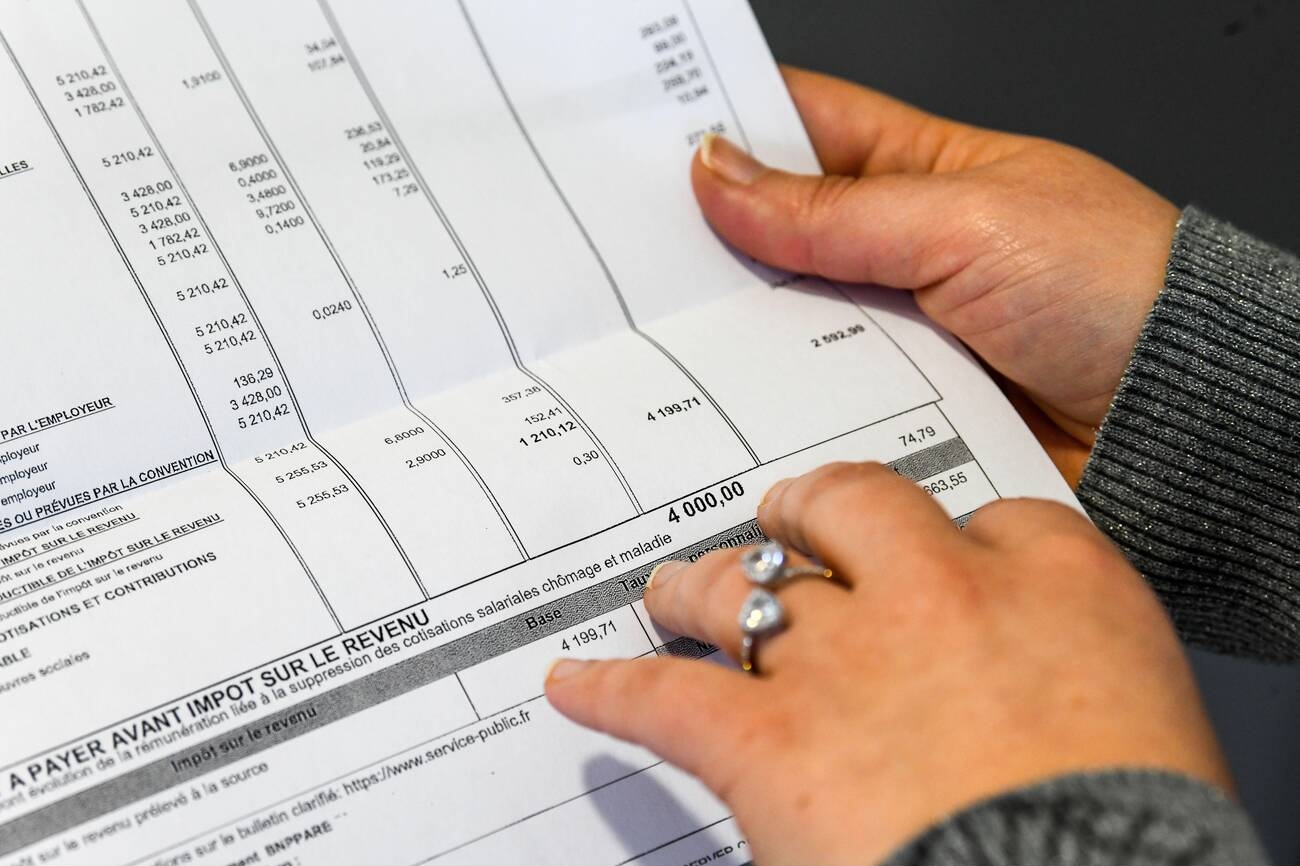

Is a Payslip Proof of Income?

A payslip is the most common proof of income by far. Typically lenders and landlords require the last two paystubs you’ve received. They then estimate the rest of the year based on that small period.

This little calculation can make a huge difference if you don’t have a completely steady paycheck. Did you work fewer hours over the holidays and as a result had a smaller paycheck? Their calculations will show your income as if your whole year was worked like your holiday season. In this case, you should wait a few pay periods so they see a more normal income amount.

If you don’t have a few pay periods to wait, you can also use other forms of documentation to prove income. Read on to

Proof of Income From the Landlord or Lender’s Perspective

Before moving on, it’s helpful to understand proof of income from your potential landlord’s or lender’s perspective.

If a guy off the street asked you for one hundred dollars and promised he’d pay you back, would you give it to him? What if he promised to pay it back with interest? If you’re an average person, you’d probably say no and walk away quickly. Why? Because you have no reason to believe he would pay even a cent back, not to mention with interest. This is the situation a lending bank is in. Even if they trust your character, they need to make sure you can make the monthly payments.

Landlords:

Landlords have to be selective about tenants. A bad tenant can damage property, adversely affect neighbors, and cost more money than they’re worth. If a tenant decides to stop paying rent, it creates legal fees in evicting the tenant, the cost of months unpaid, and lost revenue for every day it takes to re-fill the residence. This is why renters nearly always request proof of income. They need to know that you can make monthly payments punctually.

Typically, landlords are looking for your total monthly income to be two to three times the monthly rent. This is key to knowing if your rental application will be approved. If your day job doesn’t total to 3 times the rent, but you have other streams of income, you’ll want to submit documents verifying your income from those side gigs as well. This can bump your income up to the standard and show a landlord that you’ll be able to make rent easily.

Banks:

Banks are a more complex story, if simply because they have more complex options. Capital One, for example, needs documents that verify that you have $425 leftover after rent or mortgage payments. And that’s just for a credit card. For mortgage loans, most lenders require you to be paying 25% or more of your pre-tax income on their mortgage. Personal and auto loans vary greatly, but they also require proof of income in their applications.

How Do You Show Proof of Income Without Pay Stubs?

There are many reasons you might want to use different documents as your proof of income. Maybe you are a salesperson and your most recent commission checks were a little low. Maybe you are a business owner and don’t get “paystubs” like a normal employee. Maybe your employer simply doesn’t give you regular paystubs. Read on for our guide to navigating common paystub-less scenarios.

How to Show Proof of Income:

How to Get Proof of Income If Your Employer Doesn’t Give You Paystubs:

Your first approach in this scenario should be approaching your employer about receiving pay stub documents. These statements are valuable to both employees and businesses and help with more than apartment hunting.

If your employer still chooses not to deliver pay documentation, don’t worry — you can submit several other documents. If your pay hasn’t changed much from the previous tax season, dig your most recent W2 out of your tax documents and submit that as your proof of income. If you have gotten a raise or changed jobs, and expect to make much more or less, don’t use your W2 form. You can use the offer letter from your new job that states your wages, have your employer verify with your landlord over the phone, or even just submit your bank statements.

And don’t forget that your pay stubs are just records. If you know your income information, you can use CheckStubMaker’s pay stub tool to create your own pay stub, with accurate tax information automatically generated for you.

A note: if your employer won’t provide pay documentation because they are paying you “under the table” in cash or personal transfers, be very cautious! You should get their agreement in writing at the very least, and should probably become an independent contractor and make them sign a work agreement. As an independent contractor, you probably won’t get a pay stub, but at least you will be protected legally in the case of a falling out.

How Do Independent Contractors Show Proof of Income?

Very few businesses furnish their independent contractors with a pay stub. However, as part of a work agreement, the business or individual who hired a contractor should be required to send a 1099 statement. A 1099 form is a tax document that records the income of independent contractors. Your 1099s from the past one to three months will verify your income to a landlord or lender.

How to Show Proof of Income as a Business Owner:

If you are a full-fledged business owner you may not be receiving 1099s or pay stub documents. It also precludes the option of an offer letter or employer verification. That said, you’re still paying yourself. You can submit the previous years W2 (again, as long as it is recent or still represents your income) or simply show them your personal bank statements. Send them the last 1-3 months of transfers into your bank account. (You also have the less invasive option of generating your own tax-accurate pay stub and submitting that.)

How Do I Get Proof of Income If Unemployed?

There’s a reason it’s called “proof of income” and not “proof of employment”. In fact, if a bank or landlord asks for “proof of wages”, or “proof of salary”, it’s considered discrimination and they can get in serious trouble. Instead of pay stubs or bank statements, you can submit any compensation or subsidy records you have. These documents come in many forms, including social security statements, workman’s compensation letters, unemployment statements, and more. Whatever benefits you receive from the government or elsewhere, hang on to the documents and you can use this in lieu of a pay stub.

How Do I Show Proof of Income If I’m Retired?

Retirees make great tenants — and landlords will be glad to get you in a home. But providing proof of income can be trickier in retirement. This is simply because the retiree’s income comes from multiple sources. This can include social security benefits, 401k or other IRA withdrawals, annuities, pension distributions, and more. The good news is each of these income streams come with their own documentation. Gather up all the documents, put them together in a proof of income letter, and submit that to the bank or landlord you’re working with.

There are many ways to furnish proof of income, no matter what your stage of life or employment status. So go get that new apartment, car, or mortgage. If you have any trouble procuring your income-proving documents, don’t hesitate to let CheckStubMaker generate your own official pay stubs.

There are many ways to furnish proof of income, no matter what your stage of life or employment status. So go get that new apartment, car, or mortgage. If you have any trouble procuring your income-proving documents, don’t hesitate to let CheckStubMaker generate your own official pay stubs.

Proof of income is documentation verifying the amount of income you receive regularly or have received recently. It’s used by lenders and landlords to make sure that people entering credit contracts and lending agreements can actually make the payments they are agreeing to.

Proof of income is documentation verifying the amount of income you receive regularly or have received recently. It’s used by lenders and landlords to make sure that people entering credit contracts and lending agreements can actually make the payments they are agreeing to. There are many ways to furnish proof of income, no matter what your stage of life or employment status. So go get that new apartment, car, or mortgage. If you have any trouble procuring your income-proving documents, don’t hesitate to let CheckStubMaker generate your own official pay stubs.

There are many ways to furnish proof of income, no matter what your stage of life or employment status. So go get that new apartment, car, or mortgage. If you have any trouble procuring your income-proving documents, don’t hesitate to let CheckStubMaker generate your own official pay stubs.